The old conundrum exists for the job search no matter where one is looking:

You can’t get the job unless you have experience. And you can’t get experience unless you have the job.

That Catch-22 may apply to the cryptocurrency space where the news came last week that Amazon has posted a job listing seeking a Digital Currency and Blockchain Product Lead.

Drilling down into the listing, we see that the successful candidate would join the Amazon Payment Acceptance & Experience Team.

“You will leverage your domain expertise in Blockchain, Distributed Ledger, Central Bank Digital Currencies and Cryptocurrency to develop the case for the capabilities which should be developed, drive overall vision and product strategy, and gain leadership buy-in and investment for new capabilities,” reads the ad. The role pretty much starts from scratch, where the role will “develop the roadmap including the customer experience, technical strategy and capabilities as well as the launch strategy” and will be “working backwards from data and customer insights” to build the forthcoming products and services.

As one might expect, since central bank digital currencies (and to a large extent, cryptocurrencies overall) do not exist yet in any well-defined or firmly entrenched way for retail payments, the Amazon role lists some general qualifications that are geared toward new product development. Those qualifications include at least 10 years in product/program management, product marketing, business development or technology. The ad also seeks “experience with end-to-end product delivery.”

Targeting Retail Payments

The “help wanted” posting is one that hints, of course, at Amazon’s exploration of how a digital currency might fit within the ecosystem that is being built. And it’s not the only Big Tech that has posted want ads seeking to flesh out roadmaps to apply those digital offerings.

Earlier this year, Apple posted an ad for a Business Development Manager that is focused on alternative payments, and, within that sphere, has experience with working with providers in fast payments, buy now, pay later (BNPL) and cryptos.

Walmart? As noted as far back as 2019, the commerce behemoth filed a patent to create a “digital asset” that would be tied to generating a digital currency unit that in turn would be pegged to a unity of “regular currency.” In other words, this would act as a stablecoin.

And in the filing, as noted in this space at the time, “the digital currency may be pegged to the U.S. dollar and available for use only at selected retailers or partners. In other embodiments, the digital currency is available for use anywhere.”

The Apple, Amazon and Walmart disclosures, as listed above, hint at differing strategies in coming to market with at least some crypto availability for end users. Amazon, it seems, may explore the creating of a brand new currency. Walmart seems to be intent on looking into stablecoins. Apple seems to be examining a host of alternative payments, where cryptos would be just one arrow in the proverbial quiver.

But regardless of approach, the news heralds the coming of crypto more directly into retail, in a way that sidesteps the functionality where, to date, fiat must be converted into crypto (at the consumer side of the transaction), and at the other end, crypto is converted into fiat at the other end of the transaction (at the merchant). And they seem to be approaches that do not rest wholly on bitcoin, for example, where Tesla is one of the larger and more visible enterprises taking on bitcoin as an accepted payment form. Bitcoin, as has been chronicled in this space, still has its “clunkiness” in commerce. As Keith Johnson, general manager of Ternio, said in an interview with PYMNTS bitcoin is still marked by long processing times and high transaction fees.

Walmart’s stablecoin designs may be one that works well with the eventual emergence of a central bank digital currency, and it may be the case that consumers would be most comfortable with a dollar-pegged offering.

The urgency is there, as PYMNTS’ own research has shown that 18 percent of the adult population in the U.S. is likely to use cryptos to make purchases for everyday items such as groceries, etc. And of course everyday spend is what lies at the heart of Amazon and Walmart’s commerce ecosystems. From help wanted ads to full-fledged digital coins … well, the path may be long, but the road is being mapped.

OVERVIEW

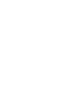

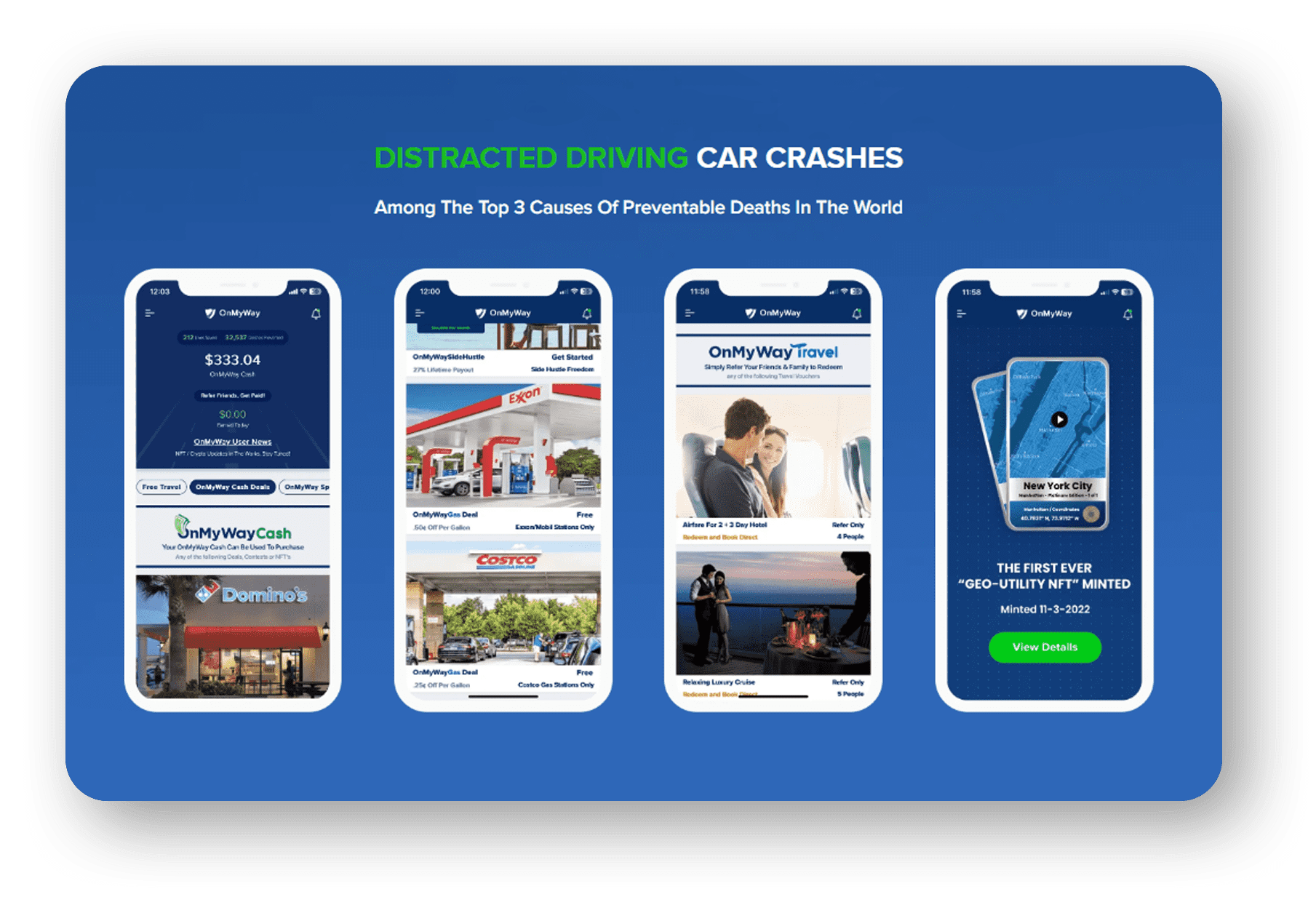

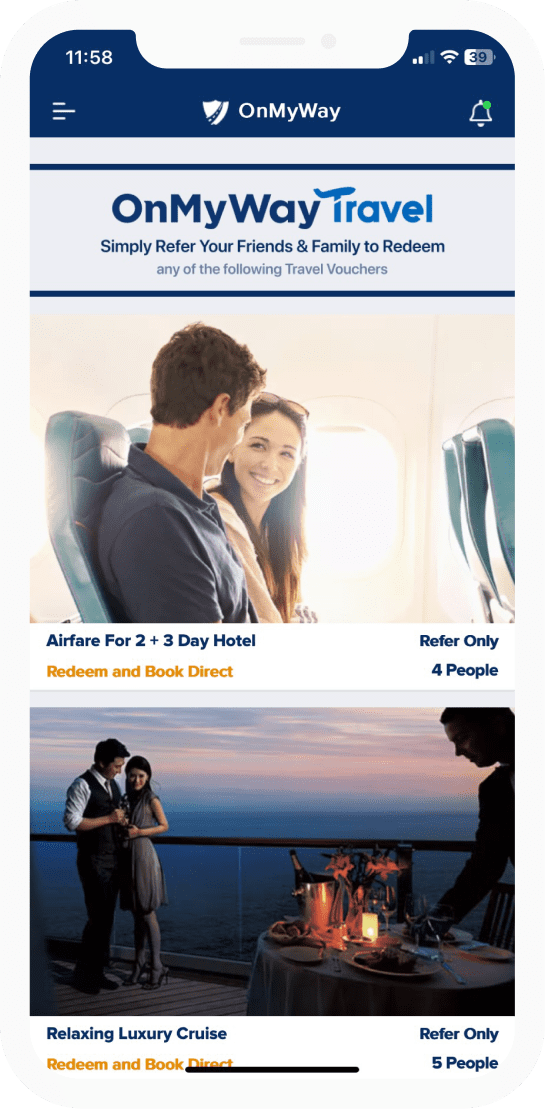

OnMyWay Is The #1 Distracted Driving Mobile App In The Nation!

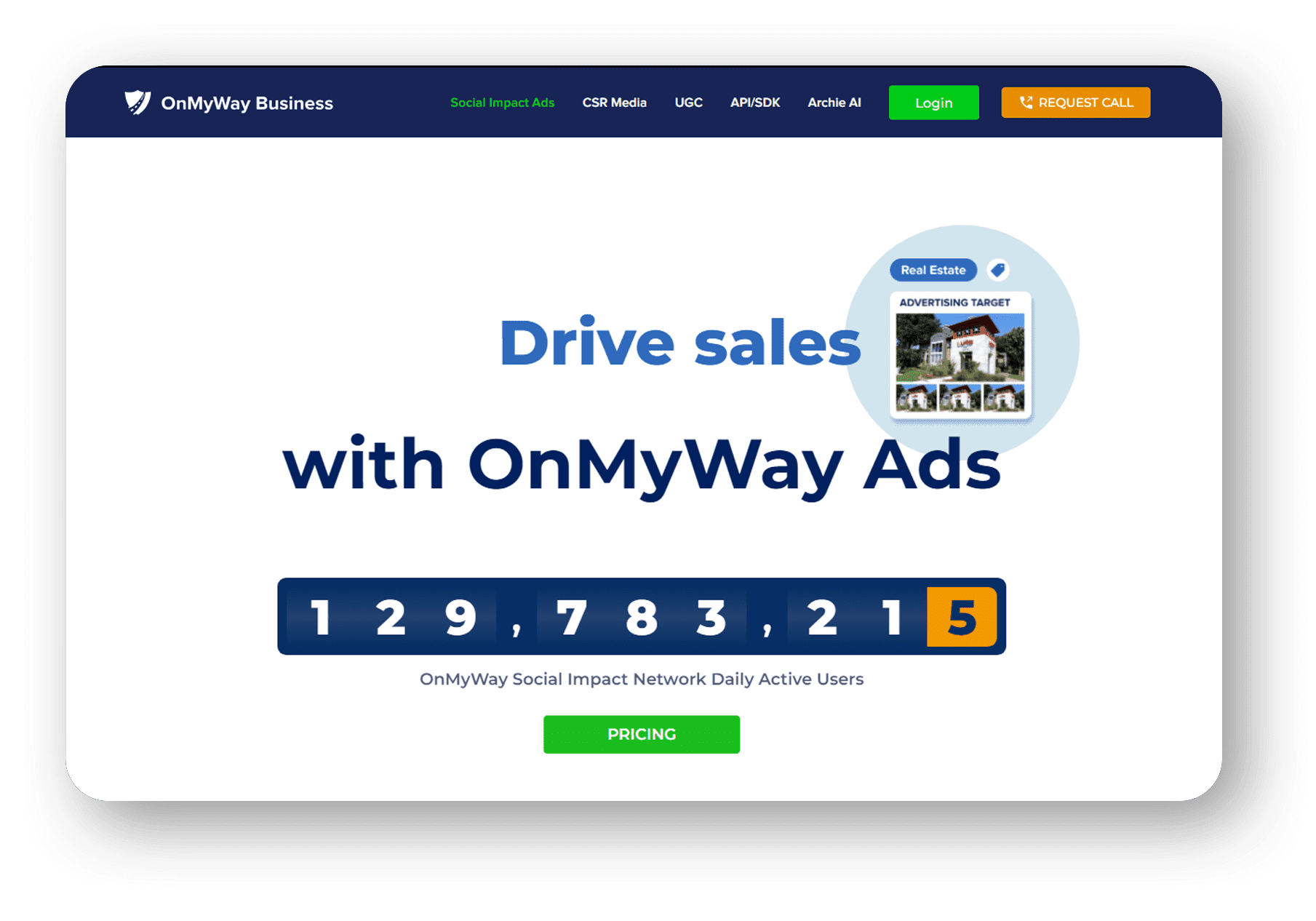

OnMyWay, based in Charleston, SC, The Only Mobile App That Pays its Users Not to Text and Drive.

The #1 cause of death among young adults ages 16-27 is Car Accidents, with the majority related to Distracted Driving.

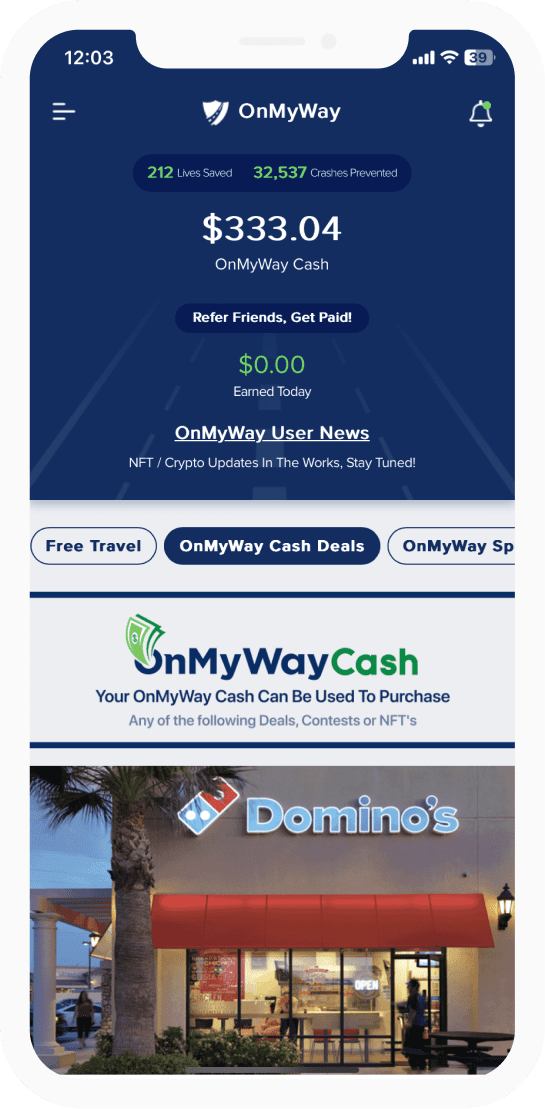

OnMyWay’s mission is to reverse this epidemic through positive rewards. Users get paid for every mile they do not text and drive and can refer their friends to get compensated for them as well.

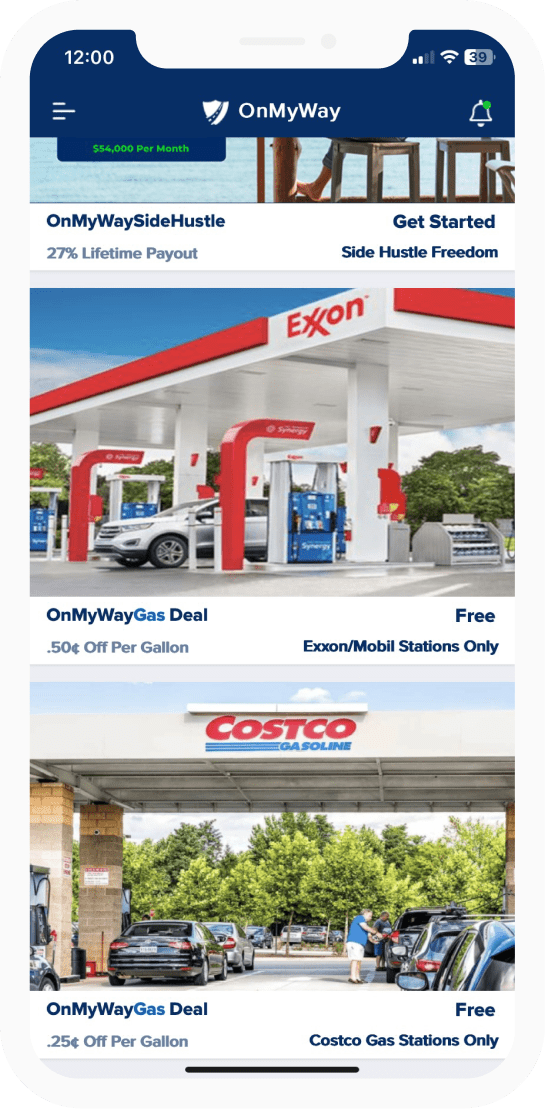

The money earned can then be used for Cash Cards, Gift Cards, Travel Deals and Much, Much More….

The company also makes it a point to let users know that OnMyWay does NOT sell users data and only tracks them for purposes of providing a better experience while using the app.

The OnMyWay app is free to download and is currently available on both the App Store for iPhones and Google Play for Android @ OnMyWay; Drive Safe, Get Paid.

Download App Now – https://r.onmyway.com

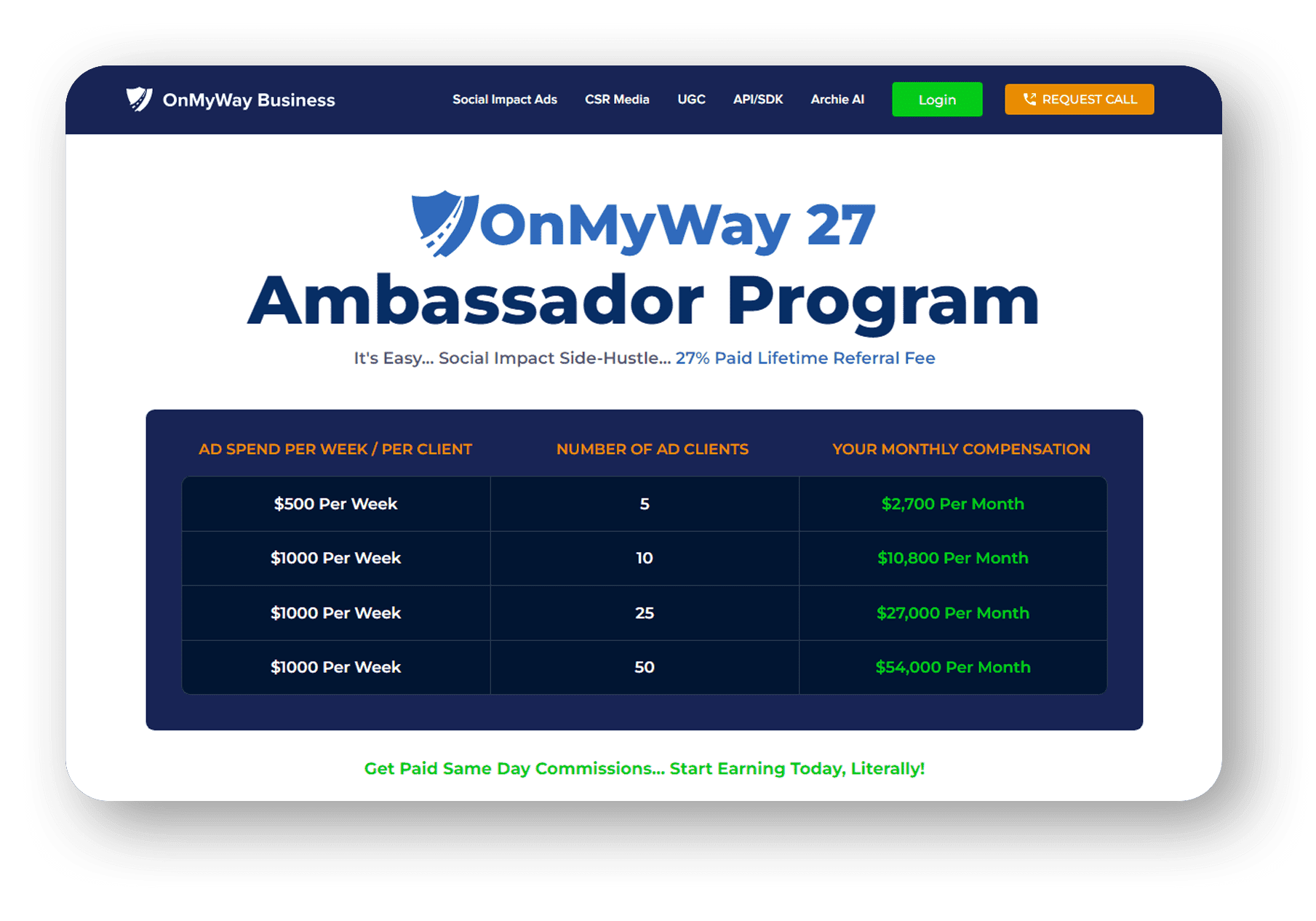

Sponsors and advertisers can contact the company directly through their website @ www.onmyway.com.