Consumer prices rose 8.2% in September compared with a last year, the government said Thursday. On a month-to-month basis, prices increased 0.4% from August to September after having ticked up 0.1% from July to August.

The September inflation numbers aren’t likely to change the Fed’s plans to keep hiking rates aggressively in an effort to wrest inflation under control. The Fed has boosted its key short-term rate by 3 percentage points since March, the fastest pace of hikes since the early 1980s. Those increases are intended to raise borrowing costs for mortgages, auto loans and business loans and cool inflation by slowing the economy.

Minutes from the Fed’s most recent meeting in late September showed that many policymakers have yet to see any progress in their fight against inflation. The officials projected that they would raise their benchmark rate by an additional 1.25 percentage points over their next two meetings in November and December. Doing so would put the Fed’s key rate at its highest level in 14 years.

Policymakers hope to avoid anything like that this time around. But analysts say chances of skirting a rate-hike-induced recession are fading fast, particularly because of price pressures in categories such as shelter that tend be sticky, and ongoing labor market tightness that is feeding wage pressures.

Higher prices for many services — health care, auto repair and housing, among others — drove inflation last month. A measure of housing costs jumped 0.8% in September, the biggest increase in 32 years. The Fed’s rate hikes have sharply raised mortgage rates and caused home prices to fall. But declining house prices will take time to feed through into the government’s measure.

The cost of health insurance jumped 2.1% from August to September and more than 28% over the past 12 months — a record one-year increase. The cost of auto repairs surged 15% in September from a year earlier, also a record high.

A range of services industries, including airlines, hospitals and even veterinary services — are having to rapidly raise wages to attract the workers they need. Those higher labor costs, in turn, are often passed on to consumers in the form of higher prices.

Along with lower gas prices, economists expect the prices of used cars to reduce or at least restrain inflation in the coming months. Wholesale used car prices have dropped for most of this year, though the declines have yet to show up in consumer inflation data. (Used vehicle prices had soared in 2021 after factory shutdowns and supply chain shortages reduced production.)

As the elections near, Americans are increasingly taking a dim view of their finances, according to a new poll by The Associated Press-NORC Center for Public Affairs Research. Roughly 46% of people now describe their personal financial situation as poor, up from 37% in March. That sizable drop contrasts with the mostly steady readings that had lasted through the pandemic.

Thursday’s report represents the final US inflation figures before the November 8 midterm elections after a campaign season in which spiking prices have fuelled public anxiety, with many Republicans casting blame on President Joe Biden and congressional Democrats.

Speaking on Thursday in Los Angeles, Biden acknowledged the pain that inflation is causing many people, while suggesting that the latest figures showed some progress”.

There’s a saying in economics that prices go up like rockets and down like feathers, said Eric Swanson, a former Fed economist who is now a professor at the University of California, Irvine. You’re kind of seeing that a little bit.

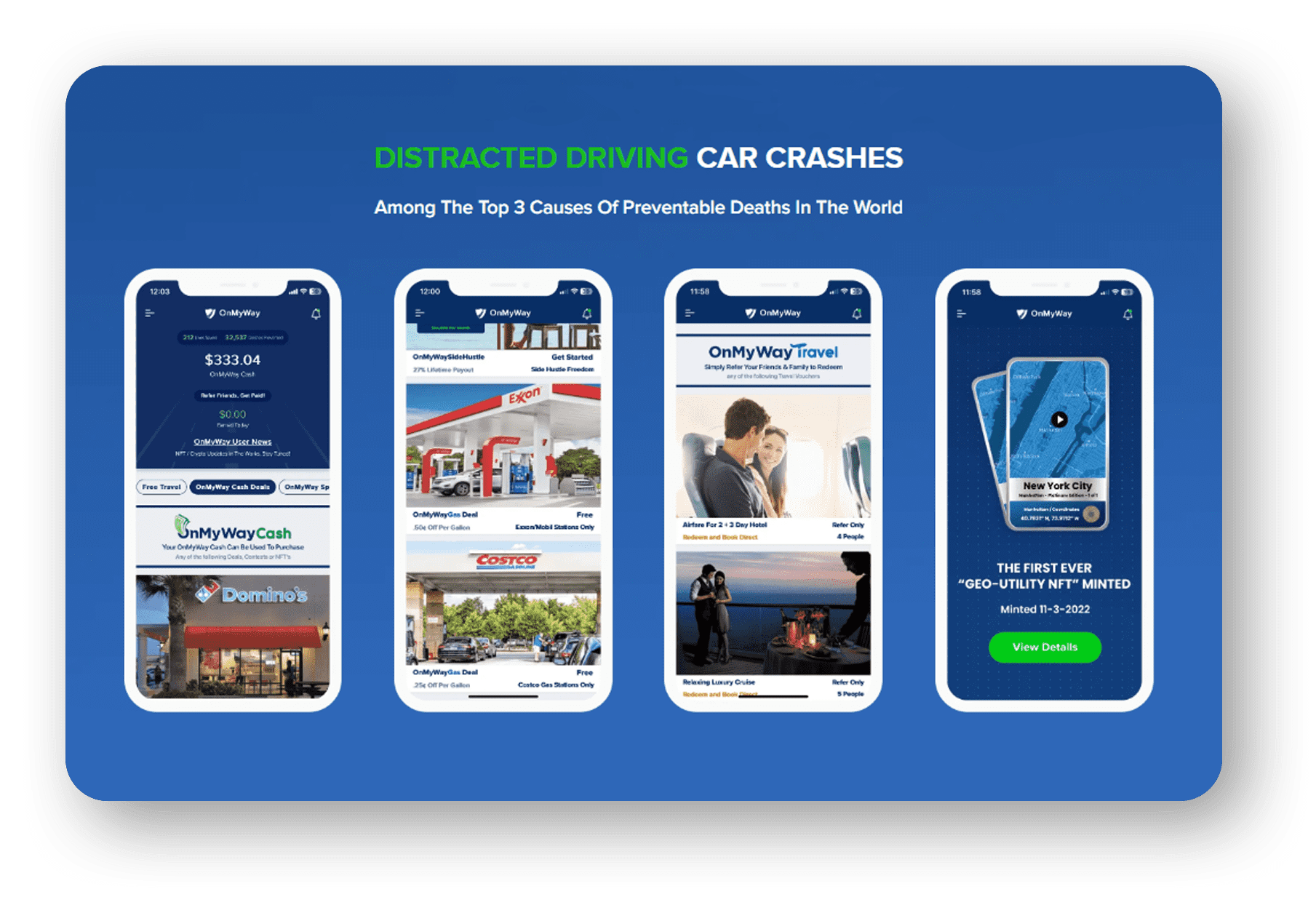

OVERVIEW

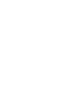

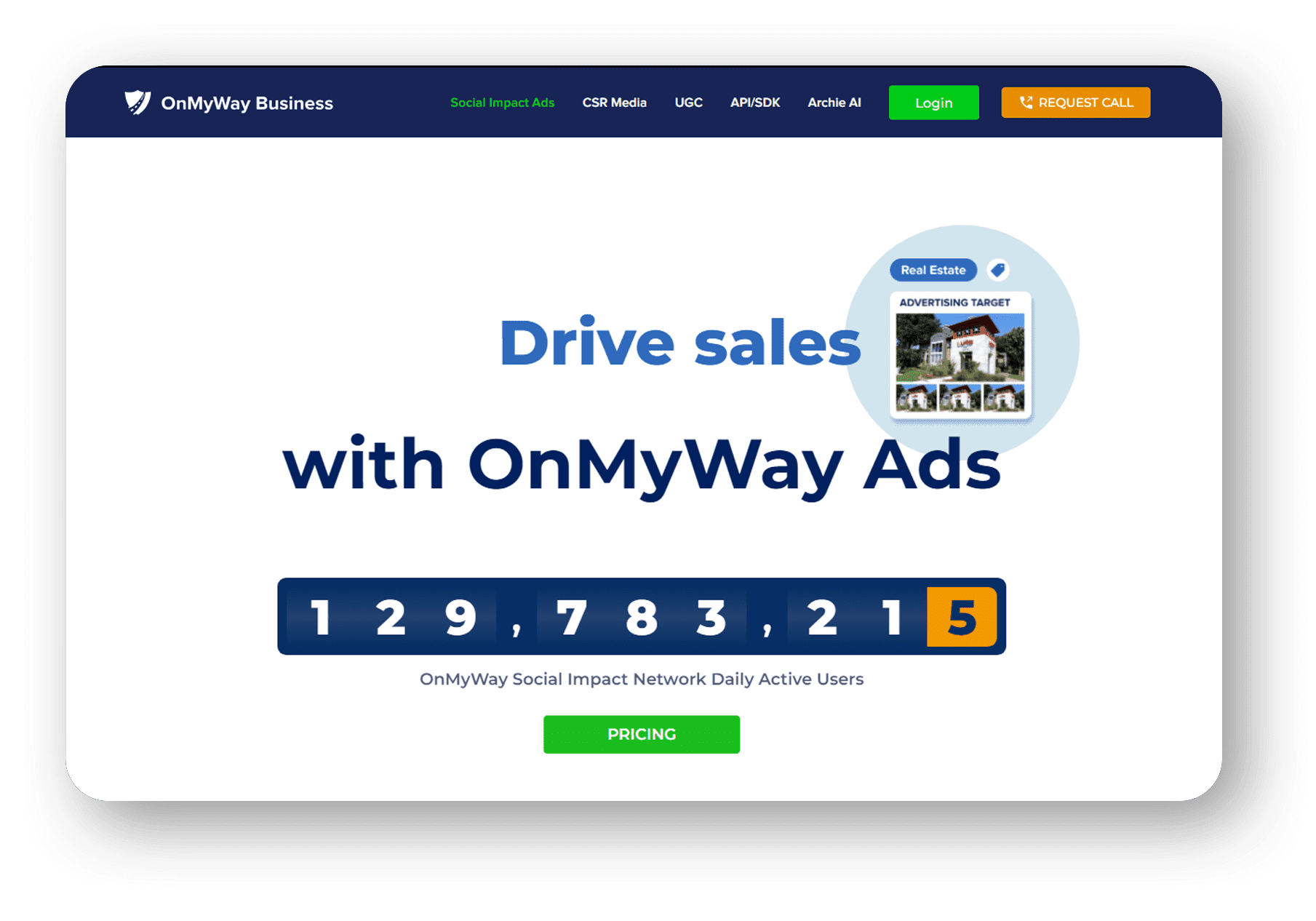

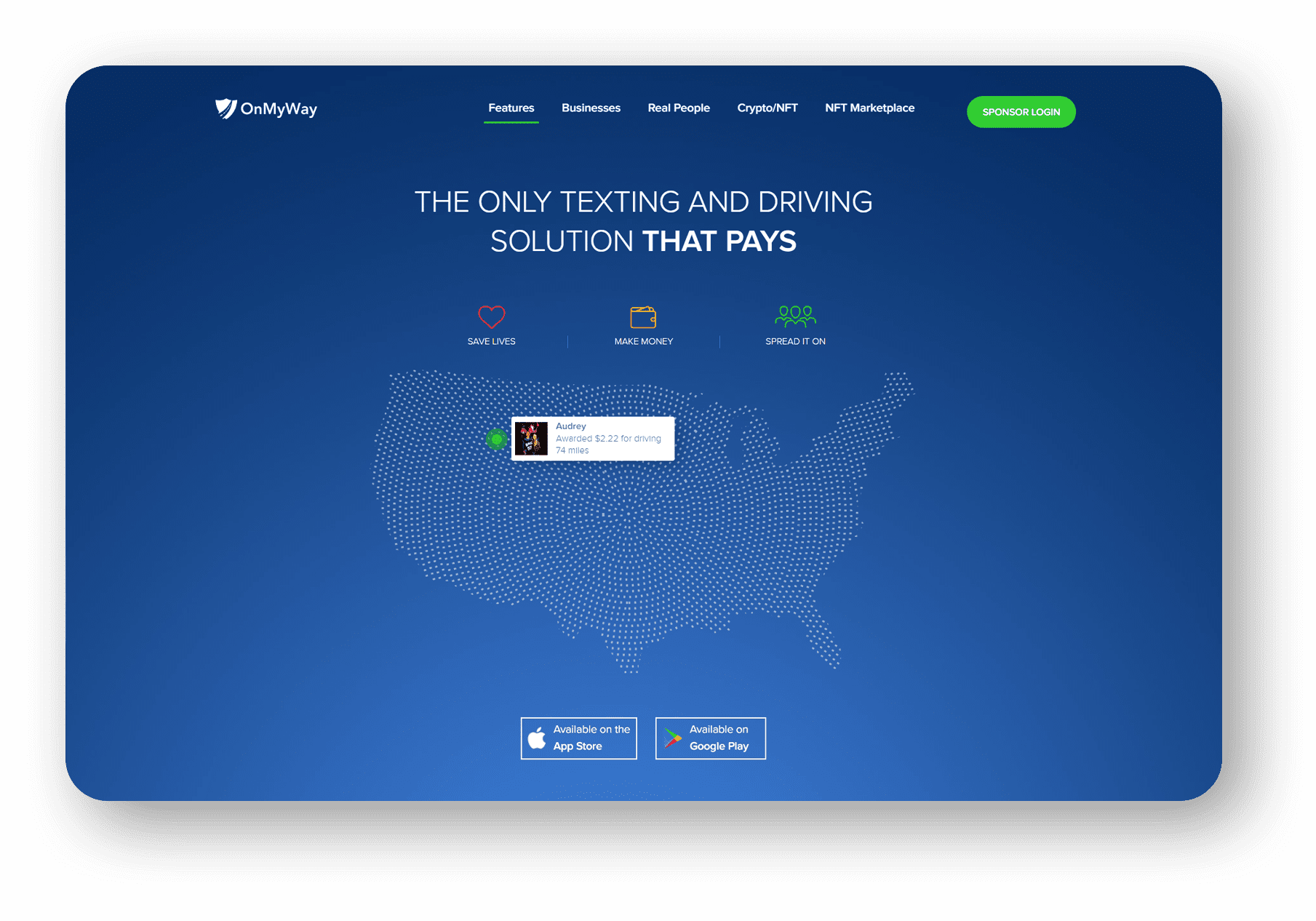

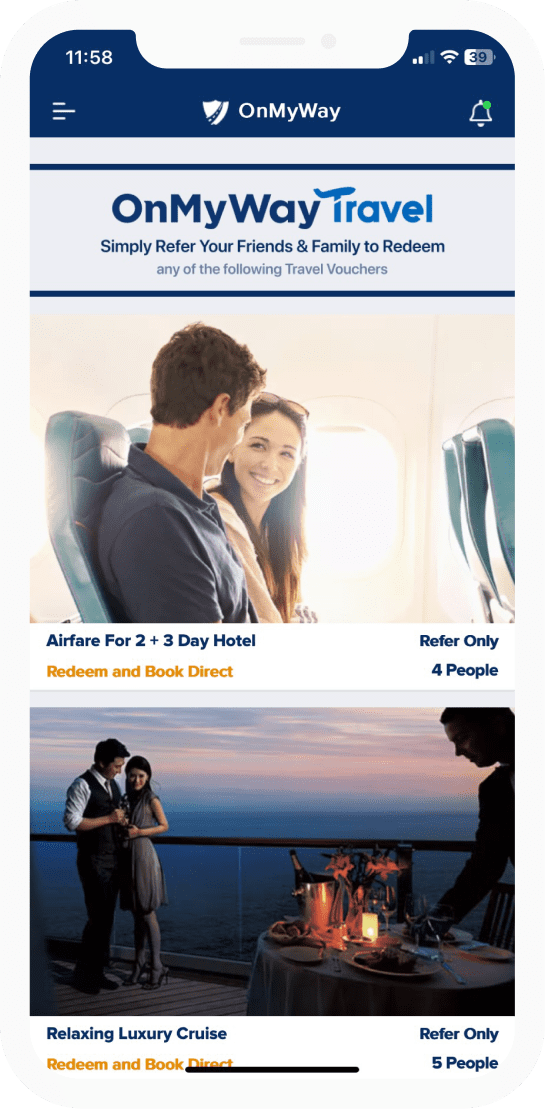

OnMyWay Is The #1 Distracted Driving Mobile App In The Nation!

OnMyWay, based in Charleston, SC, The Only Mobile App That Pays its Users Not to Text and Drive.

The #1 cause of death among young adults ages 16-27 is Car Accidents, with the majority related to Distracted Driving.

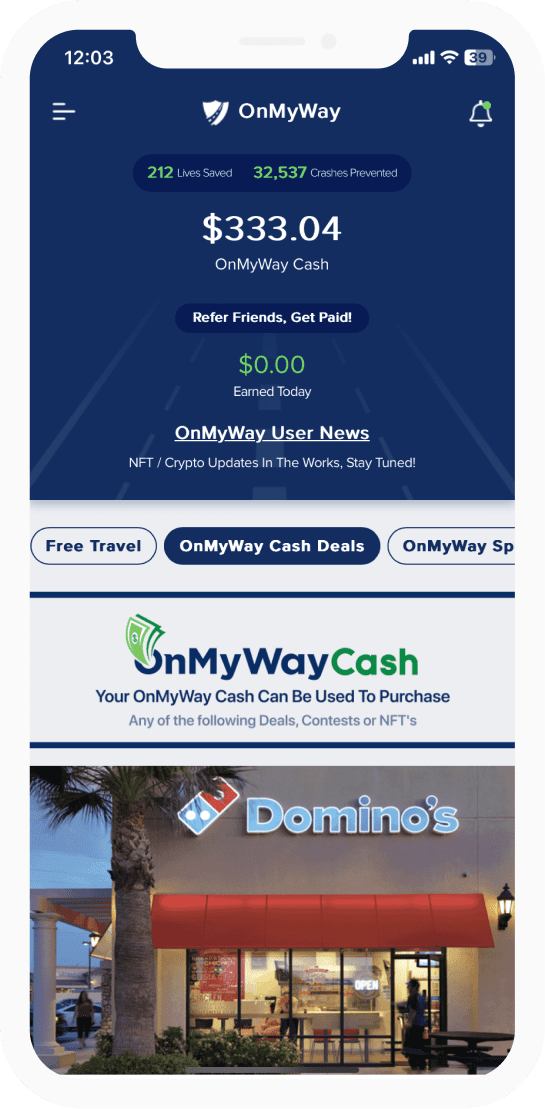

OnMyWay’s mission is to reverse this epidemic through positive rewards. Users get paid for every mile they do not text and drive and can refer their friends to get compensated for them as well.

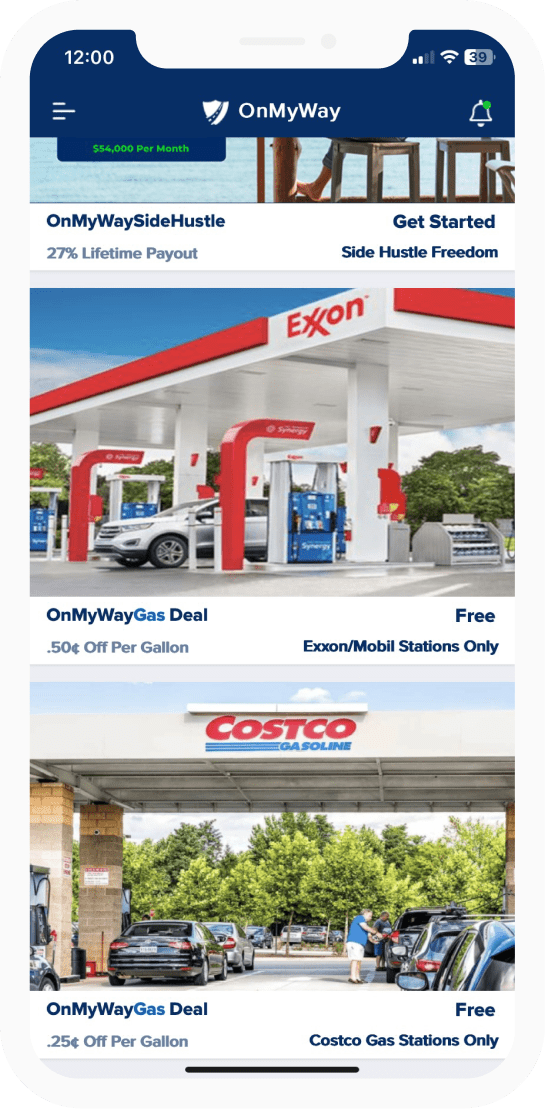

The money earned can then be used for Cash Cards, Gift Cards, Travel Deals and Much, Much More….

The company also makes it a point to let users know that OnMyWay does NOT sell users data and only tracks them for purposes of providing a better experience while using the app.

The OnMyWay app is free to download and is currently available on both the App Store for iPhones and Google Play for Android @ OnMyWay; Drive Safe, Get Paid.

Download App Now – https://r.onmyway.com

Sponsors and advertisers can contact the company directly through their website @ www.onmyway.com