THERE are indications that banks’ savings deposits may be compressed for the rest of the year following the rebound of mutual funds which are set to offer better returns than what is available from banks.

Experts describe a mutual fund as a professionally-managed investment scheme, usually run by an asset management company that brings together a group of people and invests their money in stocks, bonds and other securities.

In a market review titled, ‘Growth Returns to Nigerian Mutual Funds II,’ analysts at Coronation Research said savers are learning that, in the long run, Money Market funds and Fixed Income funds offer superior returns to bank deposits.

“Some Money Market funds, recognising that from time to time they compete with bank deposits, allow rapid deposits and withdrawals, in order to mimic, or even improve upon the terms of deposit accounts.

“Our view is these trends will continue, with both Money Market and Fixed Income funds set to offer better returns than what is available from banks,” the analysts stated.

A savings deposit account is a bank deposit usually of an individual or a nonprofit organisation drawing regular interest and payable on 30 days’ notice.

According to the research arm of Coronation Merchant Bank, the growth of the Mutual Fund industry has resumed.

“Mutual Funds tend to attract assets once savers have been accustomed to Pension Funds, and Nigerian Pension Funds are the outstanding financial success story of the past decade, having grown to some N13.4 trillion in assets. Mutual Funds are next, we believe,” the firm noted.

After a fall in assets under management in 2021, Mutual Funds are growing again. Both the rally in equities and the recent decision by the Central Bank of Nigeria to raise interest rates support their growth.

The analysts attributed the Mutual Funds decline in 2021 for the first time in five years, to bank deposit rates which they said were higher, particularly in the first half of 2021, than Treasury Bill (T-bill) rates.

This made it difficult for Money Market funds (which hold a lot of T-bills) to compete. Things have improved this year. T-bill rates are improving and the competition from banks has abated.

According to the Securities and Exchange Commission (SEC), between December 31, 2021 and May 27, 2022, the total Net Asset Value of all regulated mutual funds grew by 8.66 per cent from N1.41 trillion ($3.38 billion) to N1.53 trillion ($3.64 billion).

This gain was primarily driven by the growth in Money Market funds (+11.78 per cent) from N547.91 billion to N612.43 billion and Fixed Income and Bond funds (+12.21 per cent) from N377.74 billion to N423.88 billion.

According to the analysts, an important side effect of low interest rates has been the meteoric rise of the equity market this year.

The NGX All-Share Index is up 23.86 per cent year-to-date. This boosted the Net Asset Value (or NAV, total assets minus total liabilities) of Equity Funds, gaining 9.84 per cent from N15.76 billion to N17.31 billion.

Going forward, “We may even see a revival in Equity Funds, which shrank drastically between 2012 and 2020 as the market declined. Significant performance of the equity market in 2020 (+50.0 per cent), a positive return in 2021 (+6.1 per cent) and the positive performance (23.86 per cent) year-to-date suggest that investors may warm to these again,” the firm observed.

Alternatively, it stated that investors may take positions in Balanced Funds (also known as Mixed Funds) which hold a combination of fixed income securities and equities. Available records show that Mixed Funds are up 8.89 per cent from N29.27 billion to N31.88 billion year-to-date.

Nearly two weeks ago, the Central Bank of Nigeria (CBN) raised its Monetary Policy Rate from 11.50 per cent to 13.00 per cent.

Although this did not immediately cause a large rise in market rates (i.e. T-bill rates and FGN bonds rates), it strengthened expectations that market interest could rise later this year.

“If market interest rates do rise, then we expect to see investors move into Money Market funds and Fixed Income funds,” Coronation Research analysts stated.

OVERVIEW

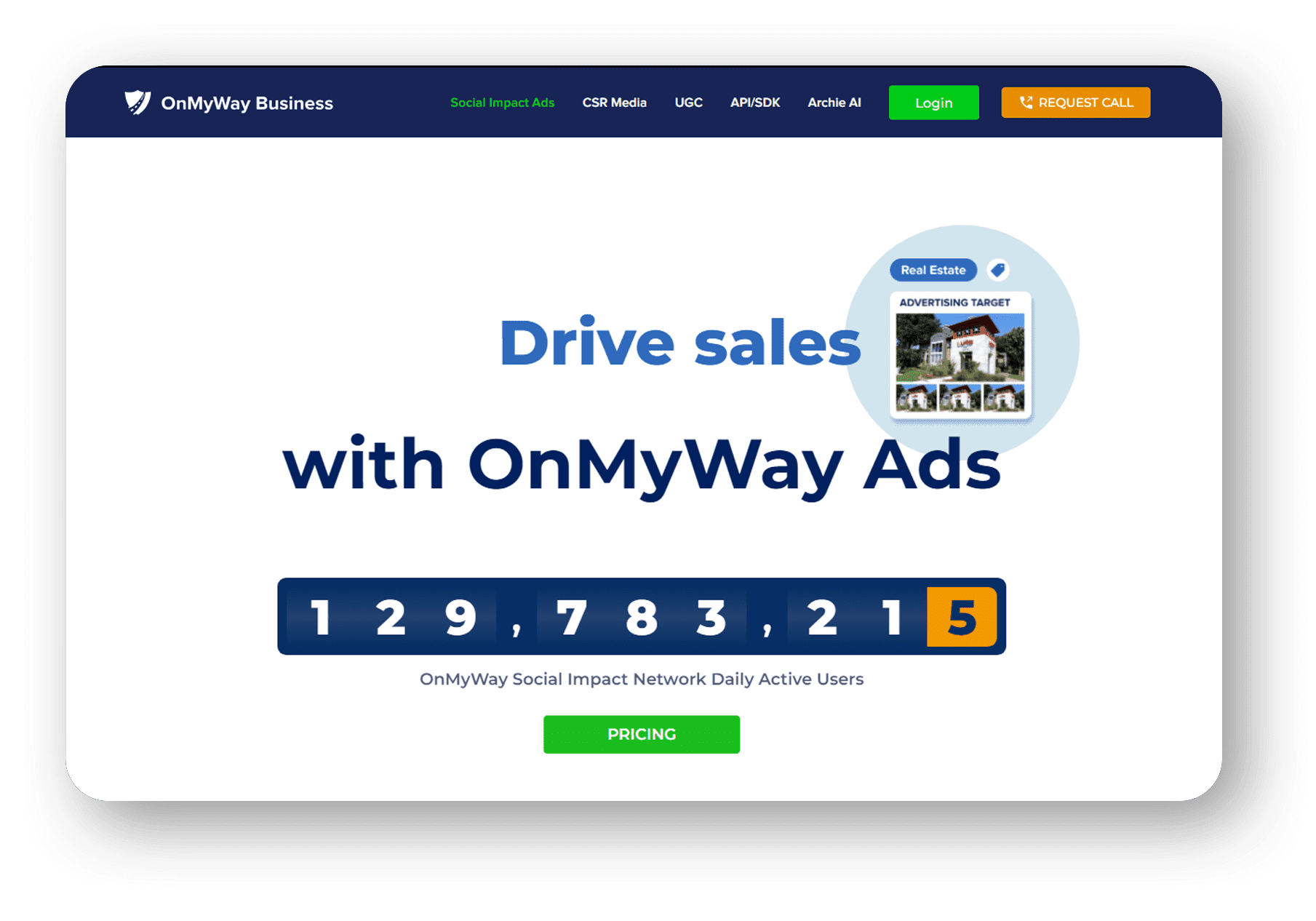

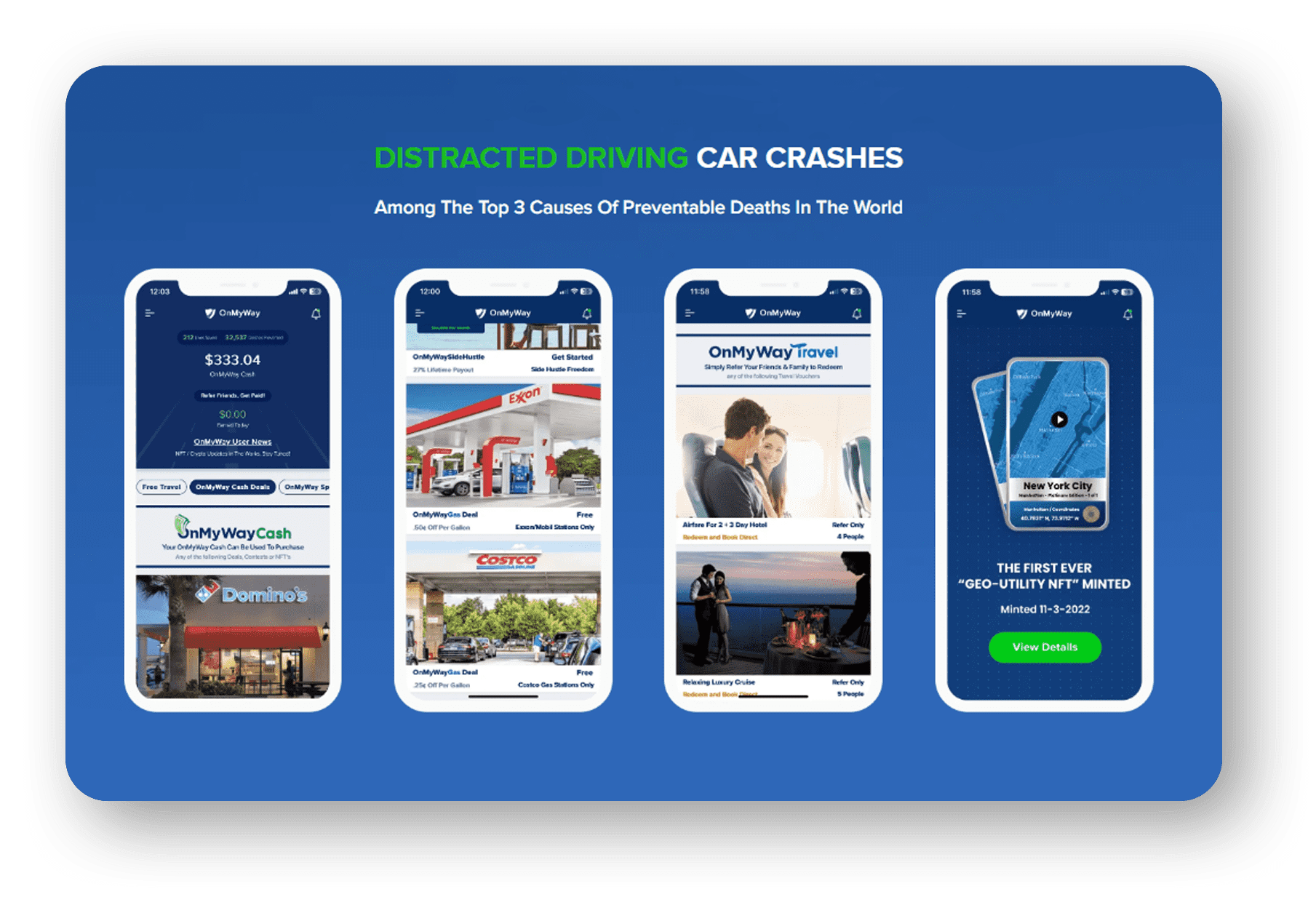

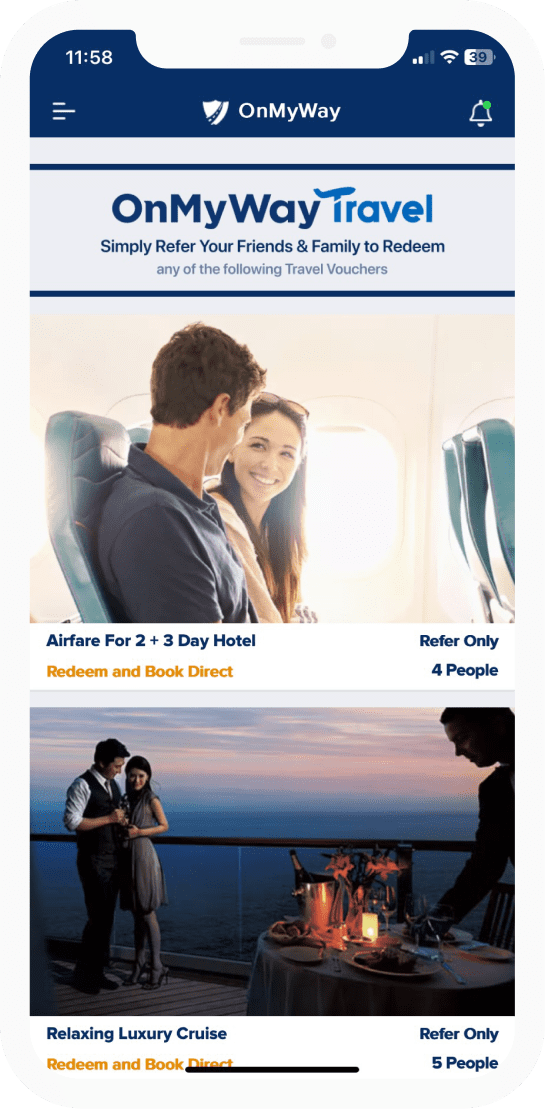

OnMyWay Is The #1 Distracted Driving Mobile App In The Nation!

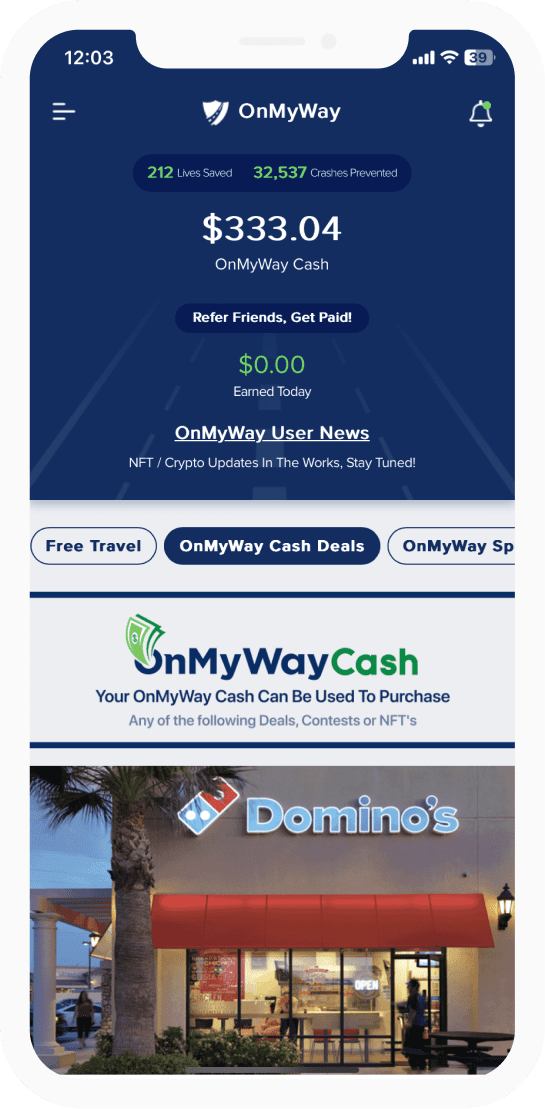

OnMyWay, based in Charleston, SC, The Only Mobile App That Pays its Users Not to Text and Drive.

The #1 cause of death among young adults ages 16-27 is Car Accidents, with the majority related to Distracted Driving.

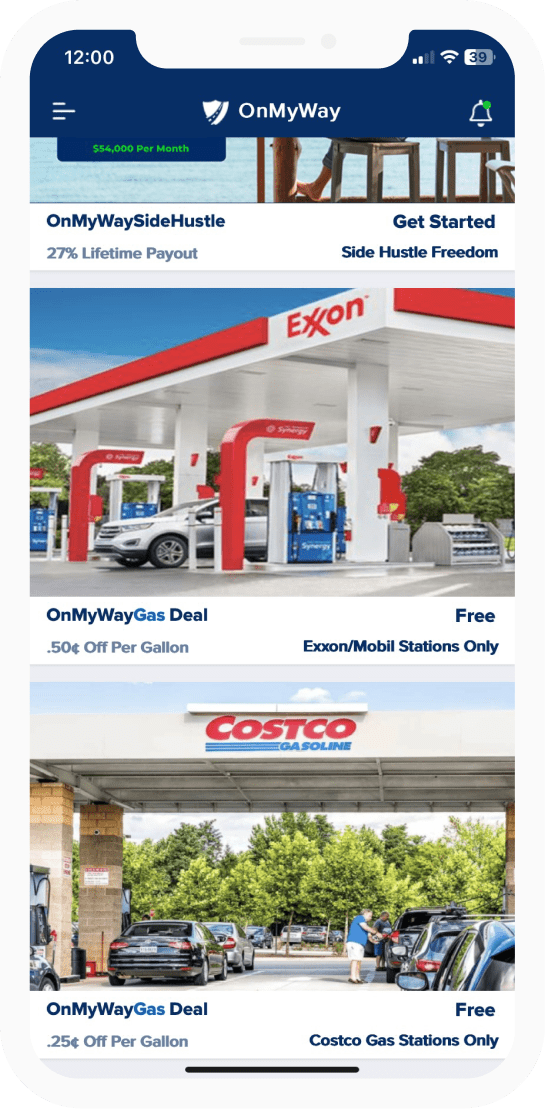

OnMyWay’s mission is to reverse this epidemic through positive rewards. Users get paid for every mile they do not text and drive and can refer their friends to get compensated for them as well.

The money earned can then be used for Cash Cards, Gift Cards, Travel Deals and Much, Much More….

The company also makes it a point to let users know that OnMyWay does NOT sell users data and only tracks them for purposes of providing a better experience while using the app.

The OnMyWay app is free to download and is currently available on both the App Store for iPhones and Google Play for Android @ OnMyWay; Drive Safe, Get Paid.

Download App Now – https://r.onmyway.com

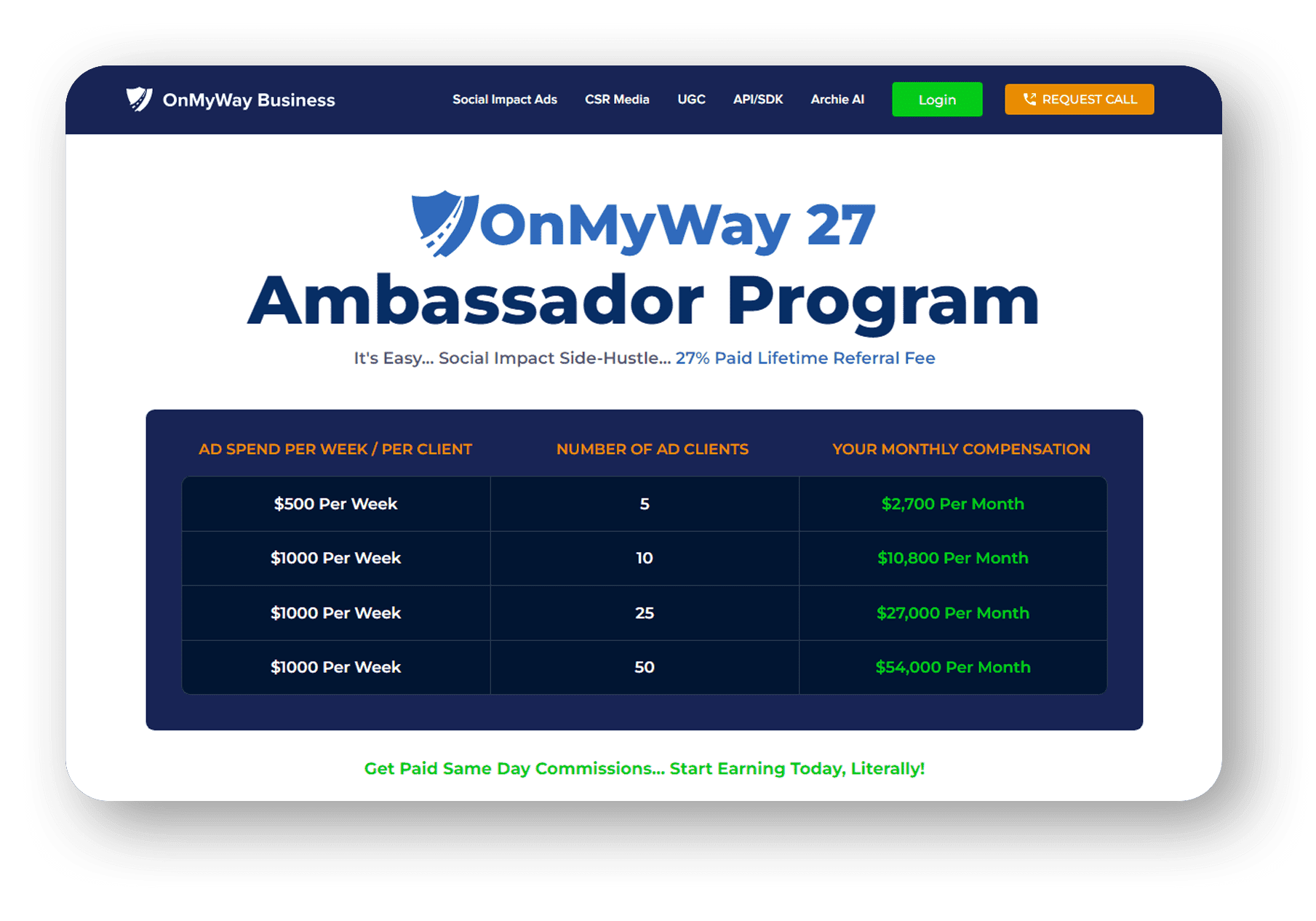

Sponsors and advertisers can contact the company directly through their website @ www.onmyway.com.