Oil prices have steadied after the cartel of major exporters and their allies reiterated plans to stick to targets to cut production, rather than increase output to make up for any shortfall from Russian supplies.

Brent crude, the international benchmark, added 1.4 per cent on Tuesday to trade at $88.64. West Texas Intermediate, the US marker, also rose 1.4 % at $81.14.

The market had a volatile previous session after the Opec group of oil-producing countries denied a report by the Wall Street Journal that the group might increase supply by up to 500,000 barrels a day. Such a move would have alleviated a potential shortfall once an EU embargo on Russian oil shipments comes into effect in early December.

However, it said it would stick to its October decision to cut production targets by 2mn b/d.

In equity markets, London’s FTSE 100 gained 0.6 per cent, boosted by gains for oil and gas majors such as BP and Shell, up 6 per cent and 3.5 % respectively. The regional Stoxx Europe 600 added 0.3 %.

Contracts tracking Wall Street’s S&P 500 and the tech-heavy Nasdaq 100 were trading flat.

Hong Kong’s Hang Seng index fell 1.3%, while China’s CSI 300 finished flat. Japan’s Topix rose 1.1% and South Korea’s Kospi shed 0.8 %.

US equities fell in the previous session as rising cases of Covid-19 in China weighed on hopes that the world’s second-biggest economy might be about to relax its virus control measures.

China’s zero-Covid stance had “suddenly returned as a very central driver for global markets” and was helping to fuel “a return to the dollar”, said Francesco Pesole, FX strategist at ING.

The dollar has inched 1 per cent higher against a basket of six other currencies over the past week, trimming its decline for November to 3.6%.

“Optimism on China’s outlook was one of the two key forces, along with speculation about a dovish pivot by the [US Federal Reserve], behind the sharp dollar correction earlier this month,” Pesole added.

St Louis Fed president James Bullard last week stressed that interest rates could yet rise above 5% as the central bank seeks to tame accelerating inflation.

In government bond markets, the two-year Treasury yield, which is particularly sensitive to interest-rate expectations, fell 0.02 percentage points to 4.5 per cent. The benchmark 10-year Treasury yield slipped 0.03 percentage points to 3.79%. Yields fall as prices rise.

OVERVIEW

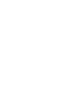

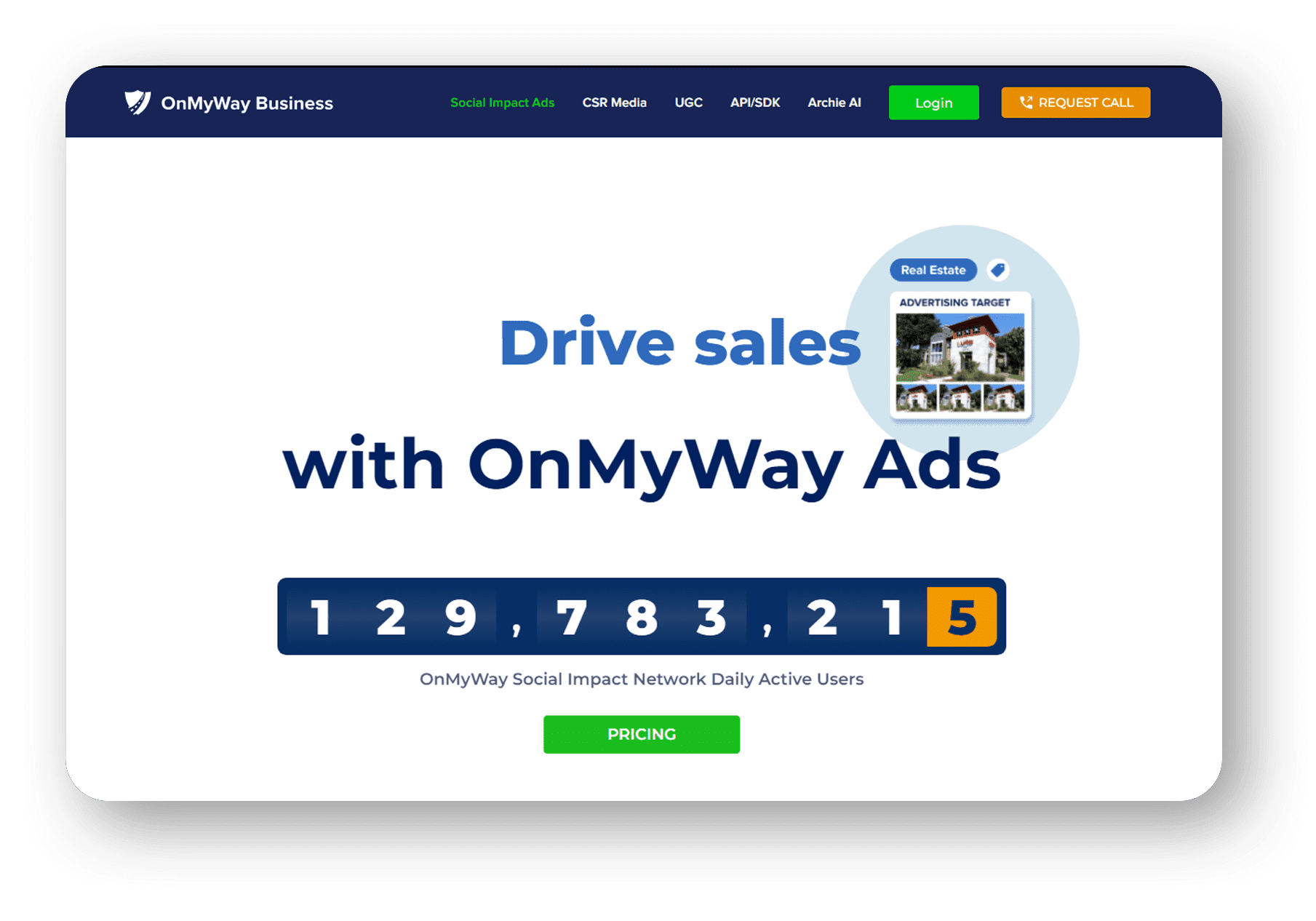

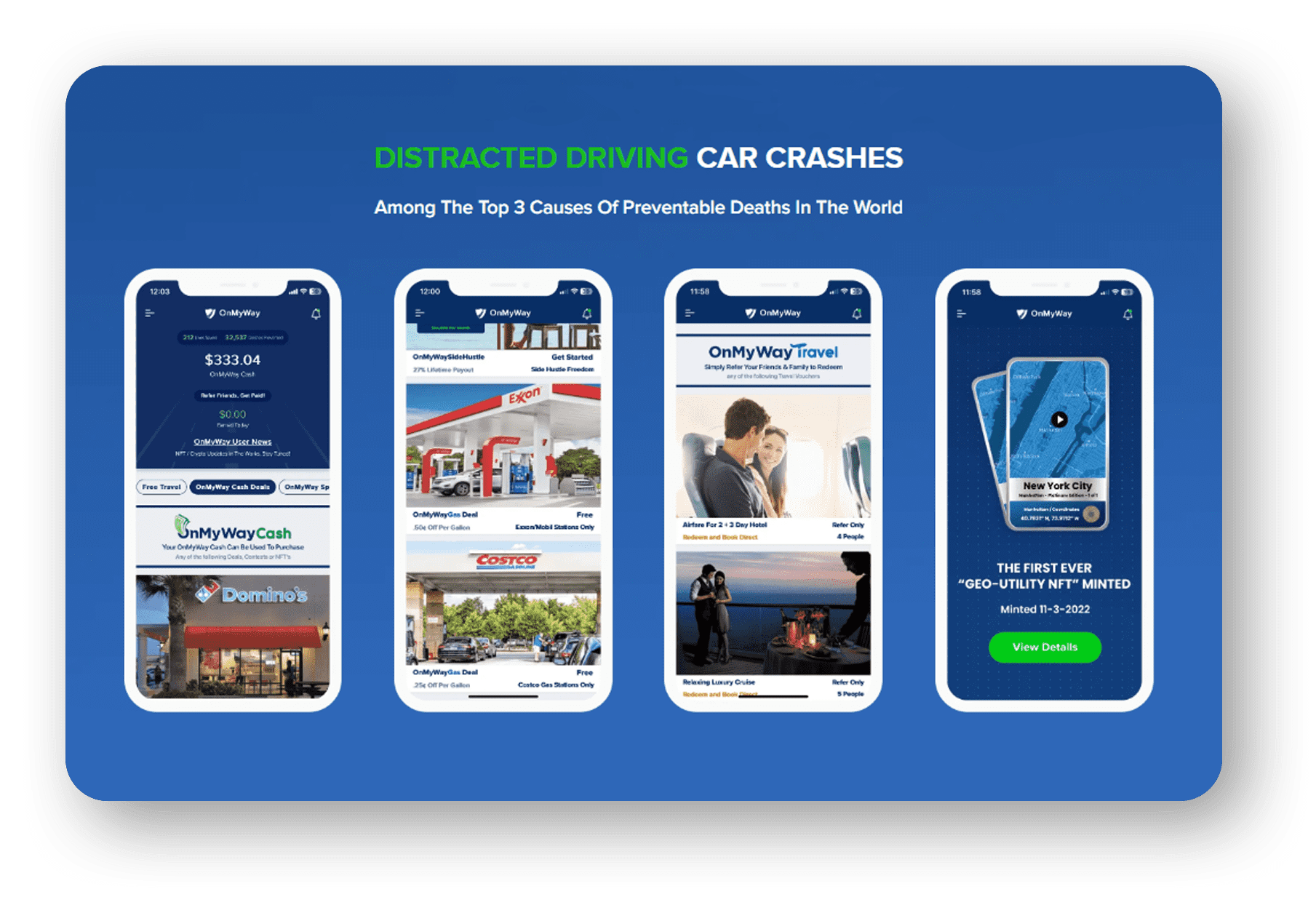

OnMyWay Is The #1 Distracted Driving Mobile App In The Nation!

OnMyWay, based in Charleston, SC, The Only Mobile App That Pays its Users Not to Text and Drive.

The #1 cause of death among young adults ages 16-27 is Car Accidents, with the majority related to Distracted Driving.

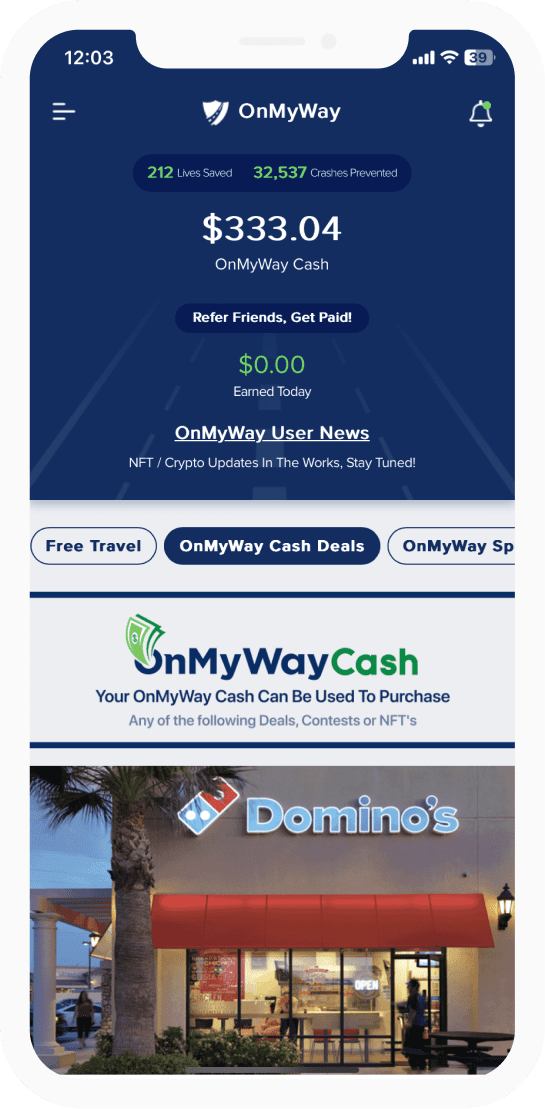

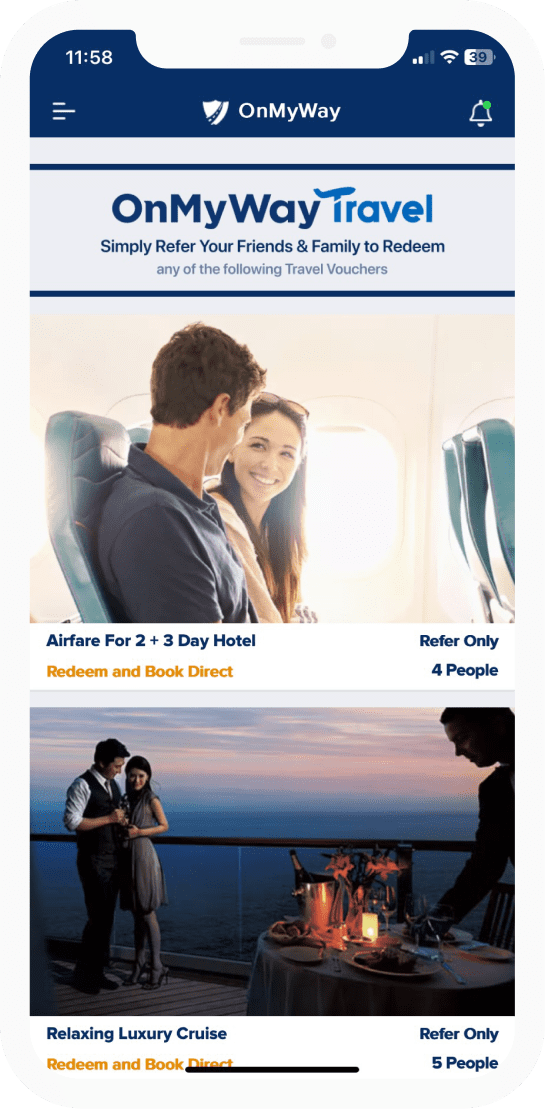

OnMyWay’s mission is to reverse this epidemic through positive rewards. Users get paid for every mile they do not text and drive and can refer their friends to get compensated for them as well.

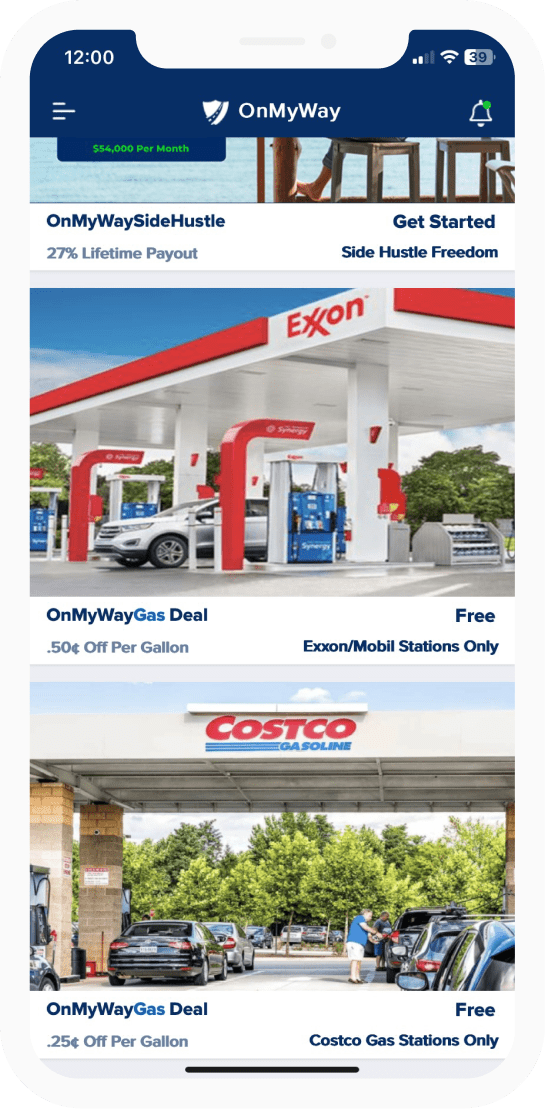

The money earned can then be used for Cash Cards, Gift Cards, Travel Deals and Much, Much More….

The company also makes it a point to let users know that OnMyWay does NOT sell users data and only tracks them for purposes of providing a better experience while using the app.

The OnMyWay app is free to download and is currently available on both the App Store for iPhones and Google Play for Android @ OnMyWay; Drive Safe, Get Paid.

Download App Now – https://r.onmyway.com

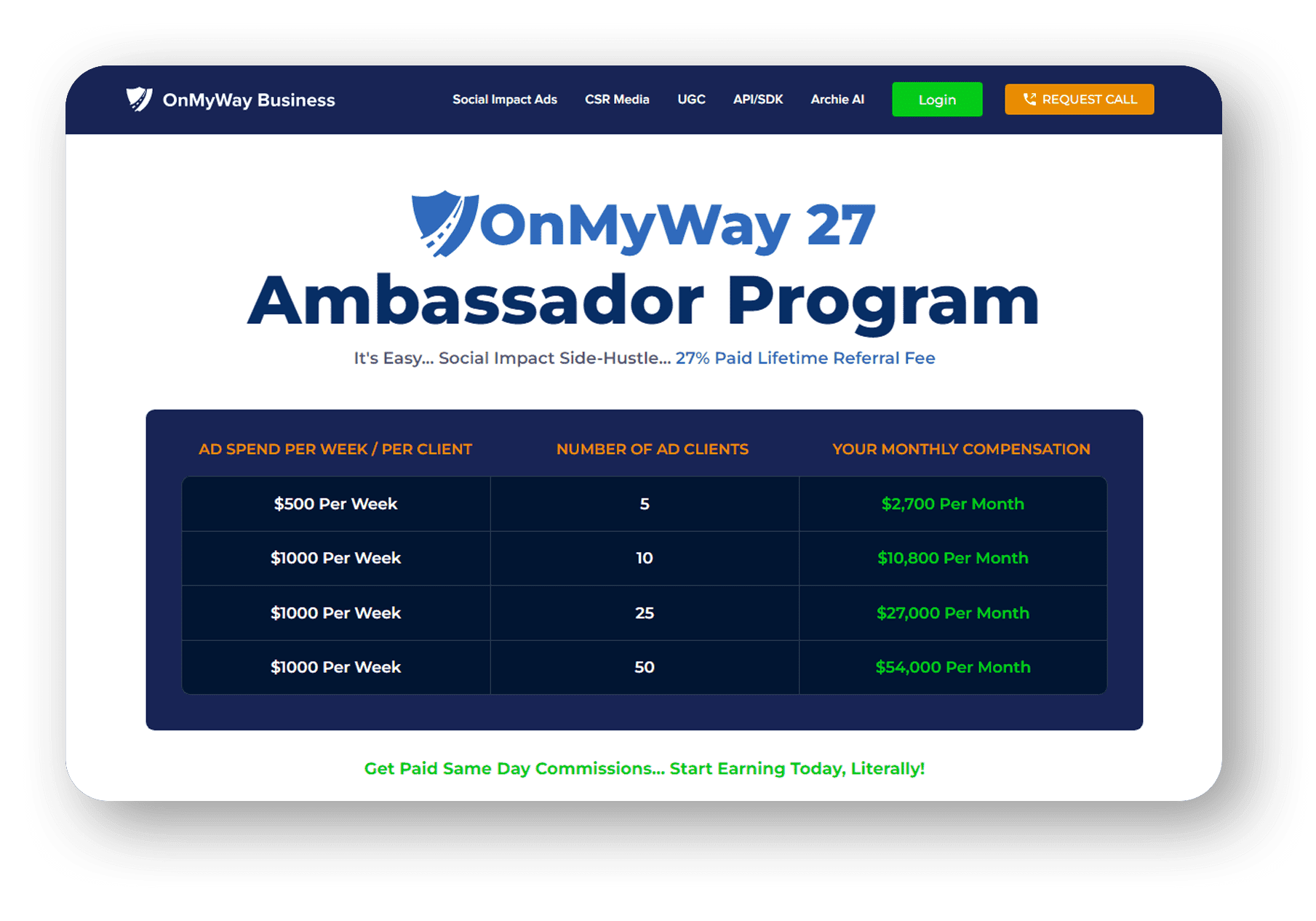

Sponsors and advertisers can contact the company directly through their website @ www.onmyway.com